LandSpace Eyes IPO on Shanghai Stock Exchange

Stock liftoff ahead of reusable rocket touchdown?

This article discusses a potential initial public offering, stock markets, and select stocks. I am not a financial advisor, and this article is not investment advice; consult a financial advisor before investing.

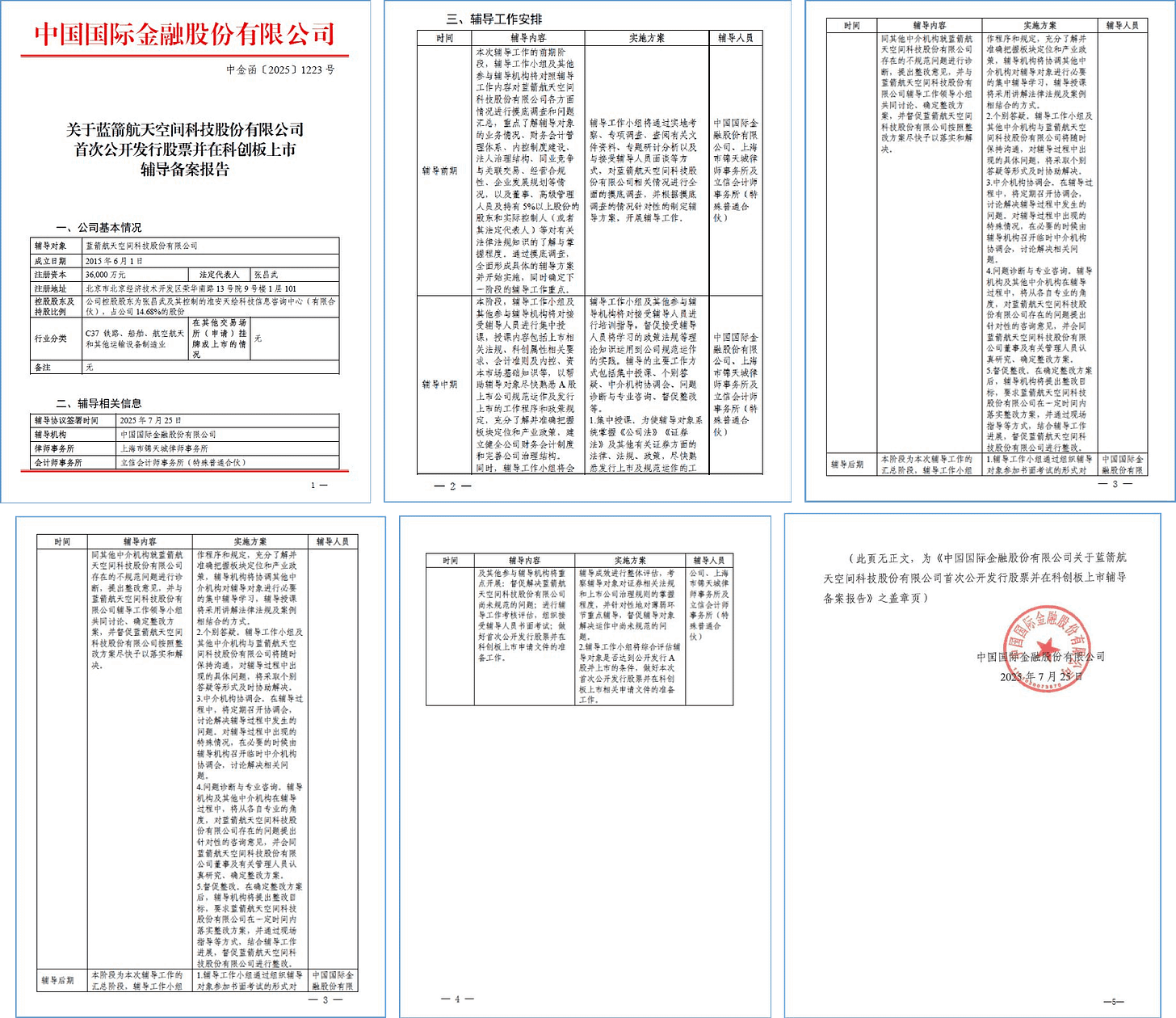

According to filings dated July 25th 2025, LandSpace is eyeing an initial public offering, commonly abbreviated as IPO, on the Shanghai Stock Exchange’s Science and Technology Innovation Board, also called the STAR Market. The innovation board’s stated purpose is to enhance the capability to serve technology innovation while promoting the high-quality development of China's economy.

Filings from LandSpace are the start towards a listing on the Shanghai Stock Exchange, which may occur around early 2026. To do so, the company is being guided and consulted by China International Capital Corporation Limited (中国国际金融股份有限公司), a financial services and investment management company, through its Zhejiang province (浙江) bureau.

The phase LandSpace is currently in, known as counseling filing, is required by the China Securities Regulatory Commission (中国证券监督管理委员会) before a company can formally apply to go public. It involves a thorough review of LandSpace’s corporate structure, internal practices, financial reporting, and legal compliance. This process ensures that the company meets listing requirements set by Shanghai’s Science and Technology Innovation Board and the stock exchange.

If this phase proceeds smoothly, LandSpace is expected to submit its initial public offering application to the exchange in the following months. After submission, the company will enter the formal review period, followed by feedback, revisions, and eventually regulatory approval. After these steps, LandSpace can finalize its plans to begin trading publicly.

Shanghai’s Science and Technology Innovation Board allows companies like LandSpace to be listed publicly without being profitable yet, so long as they have demonstrated a solid foundation of technological innovation with good growth potential. This can be especially helpful for space companies that need a large investment over a long timespan, particularly for developing and scaling up operations with reusable rockets.

At the current stage of the process to go public, it is unknown how much of LandSpace will be available to buy on the Shanghai Stock Exchange, along with how much dilution of shares will take place with prior investors. One of the larger shareholders in the company is Zhang Changwu (张昌武), LandSpace’s Founder, owning about 14.68 percent, via a holding company.

Some details on LandSpace’s financial situation were revealed with the filings, mainly that the company currently has 360 million Yuan (49.9 million United States Dollars (USD), as of August 1st) in registered capital. One month before the filing, LandSpace was valued at 20 billion Yuan (2.77 billion USD)1, according to the Hurun Research Institute’s (胡润研究院) Global Unicorn Index 2025, while having administrative, production, test, or research facilities in seven cities2.

Those details come after LandSpace had 900 million Yuan (124.8 million USD) invested from China's National Manufacturing Transformation and Upgrading Fund in December 2024, adding to a total financing of about 3.5 billion Yuan (485.36 million USD). However in April, Country Garden Holdings Company Limited (碧桂园控股有限公司) sold off 1.305 billion Yuan (180.95 million USD), representing an 11.063 percent ownership stake, in shares of the company to two other investors.

Around the Two Sessions (两会) in March, LandSpace’s Founder Zhang Changwu emphasized the need for China to match world-class standards by accelerating breakthroughs in reusable rocket technology, reducing launch costs, and carrying out more launches, while calling on relevant authorities to optimize their launch approval process. Zhang’s comments built upon suggestions from CAS Space Founder Yang Yiqiang (杨义强), who advocated for an integrated development framework that deeply combines advantages of state-funded contractors and commercial sector forces, along with stressing the importance of patient capital and stable policy to assure investors of long-term government support for the commercial space sector.

At the moment, LandSpace is arguably in a solid position ahead of its initial public offering. Recently, in June, the company completed a static fire test with its partially reusable Zhuque-3 rocket, set to debut no earlier than September. Two successful flights have also been completed with the upgraded Zhuque-2E launch vehicle, with more on the way. The company is planning the Honghu-3 (鸿鹄-3) constellation as well for a potential consistent revenue stream alongside launch services, which may come from regularly launching the GuoWang and Qianfan mega-constellations.

The timing of LandSpace’s filings to begin the process for its initial public offering will have the company go public, if approved, in early 2026. That would coincidentally, or maybe deliberately, be after at least one launch of Zhuque-3 and a possible first-stage booster landing (which could be China’s first). Having at least one flight of Zhuque-3, capable of carrying up to 21,300 kilograms to orbit, along with potentially proving booster landings, would be a strong boon for investor confidence.

Space stocks in China and abroad

Some Chinese space enterprises have completed the necessary steps to go public in years prior. In 2019, China Satellite Communications Co Ltd, state-owned and operator of the ChinaSat spacecraft fleet, went public on the Shanghai Stock Exchange and raised just over a billion Yuan (138.65 million USD). Way back in 1996, APSTAR, owner of the APSTAR satellites, became publicly listed via the Hong Kong Stock Exchange, although state-owned via the China Aerospace Science and Technology Corporation.

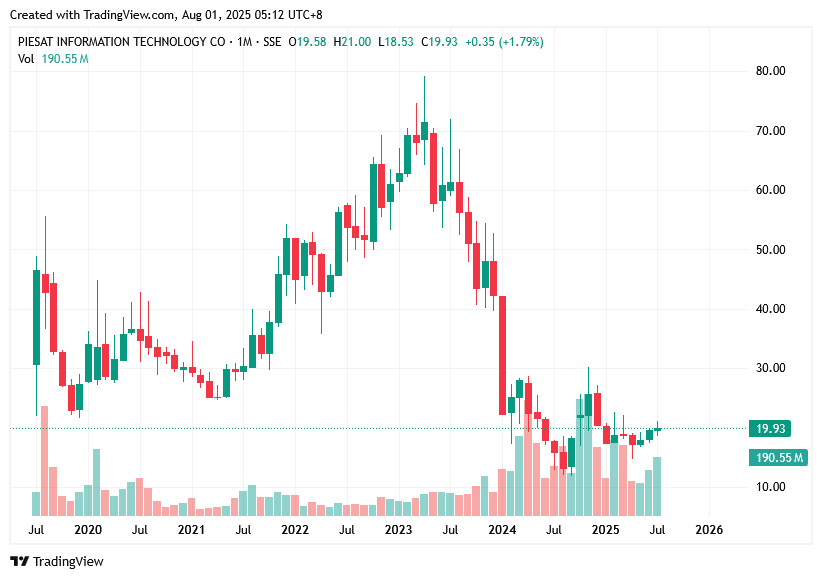

One company that has completed the process to go public, but has experienced tough times since, is Piesat Information Technology Co Ltd (航天宏图信息技术股份有限公司), operator of remote sensing satellites and seller of data from its satellites. Piesat’s share price peaked in April 2023 and has fallen by over seventy percent since. Alongside this, the company has reportedly not paid some employees since February, with some paid about forty percent of their salary since 2024. As such, several employees are taking the company to arbitration.

One company that has tried to go public, but had its initial public offering terminated, is Changguang Satellite Technology Co Ltd (长光卫星技术股份有限公司), also sanctioned by the U.S. government. A public listing of the company was reportedly halted due to its financial and business situation, but the company has recently received a multi-phased investment of 50 billion Yuan (6.93 billion USD) for a Hangzhou-based secondary headquarters capable of producing one thousand satellites per year.

(This is just to mention a few companies anecdotally, sadly I do not have infinite time to write).

Financial regulators are aiming to support space stocks through a grouping of stocks from within the sector, believed to consist of 125 enterprises, to encourage investment. Additionally, Chairman of the China Securities Regulatory Commission Wu Qing (吴清) encouraged financial markets and hubs to support scientific and technological innovation by facilitating patient capital, strengthening specialized trading boards for tech companies, and creating comprehensive financial services that cover the entire lifecycle of tech enterprises from a startup phase to business maturity.

Meanwhile, in the wider national scope, several city and provincial governments, as well as banks, are supporting the space sector alongside the Central Government. This support is through a mixture of building up industrial clusters, providing funding and financing, expanding spaceports, offering tax incentives, and granting land use rights.

A few space companies outside of China, mainly in the U.S., have gone or are seeking to go public as well. Most recently, Firefly Aerospace is aiming to go public, following its successful lunar landing earlier in the year, although it experienced a failed orbital launch weeks later. Space companies in the U.S. with a substantial focus on orbital launch have had a rocky experience going public, as I detailed when Firefly announced its intention for an initial public offering in early July:

The first to do so was Astra in early 2021, although it was later delisted in early 2024 due to the company's failure on seven out of its nine launches with its small-lift orbital rocket. Following them was Virgin Orbit, with its Boeing 747-launched small-lift rocket, in December 2021. By mid-2023, the company had filed for bankruptcy, auctioning off its assets, following a launch failure and failure to secure additional financing.

So far, the only publicly traded company performing orbital launches to survive and thrive after an initial public offering is Rocket Lab, with its small-lift carbon fiber Electron launch vehicle. The company has managed to thrive thanks to a series of strategic acquisitions to position itself within the satellite manufacturing business, producing necessary components, instruments, or entire spacecraft. This has enabled the company to work with customers from satellite design to orbital deployment. However, following launch failures and complex hardware announcements, the stock does experience drops.

Hopefully, after its initial public offering, LandSpace will be a Rocket Lab, rather than an Astra (LandSpace has already had leagues more success).

Believed to be the highest valuation for a non-state-owned Chinese space launch company.