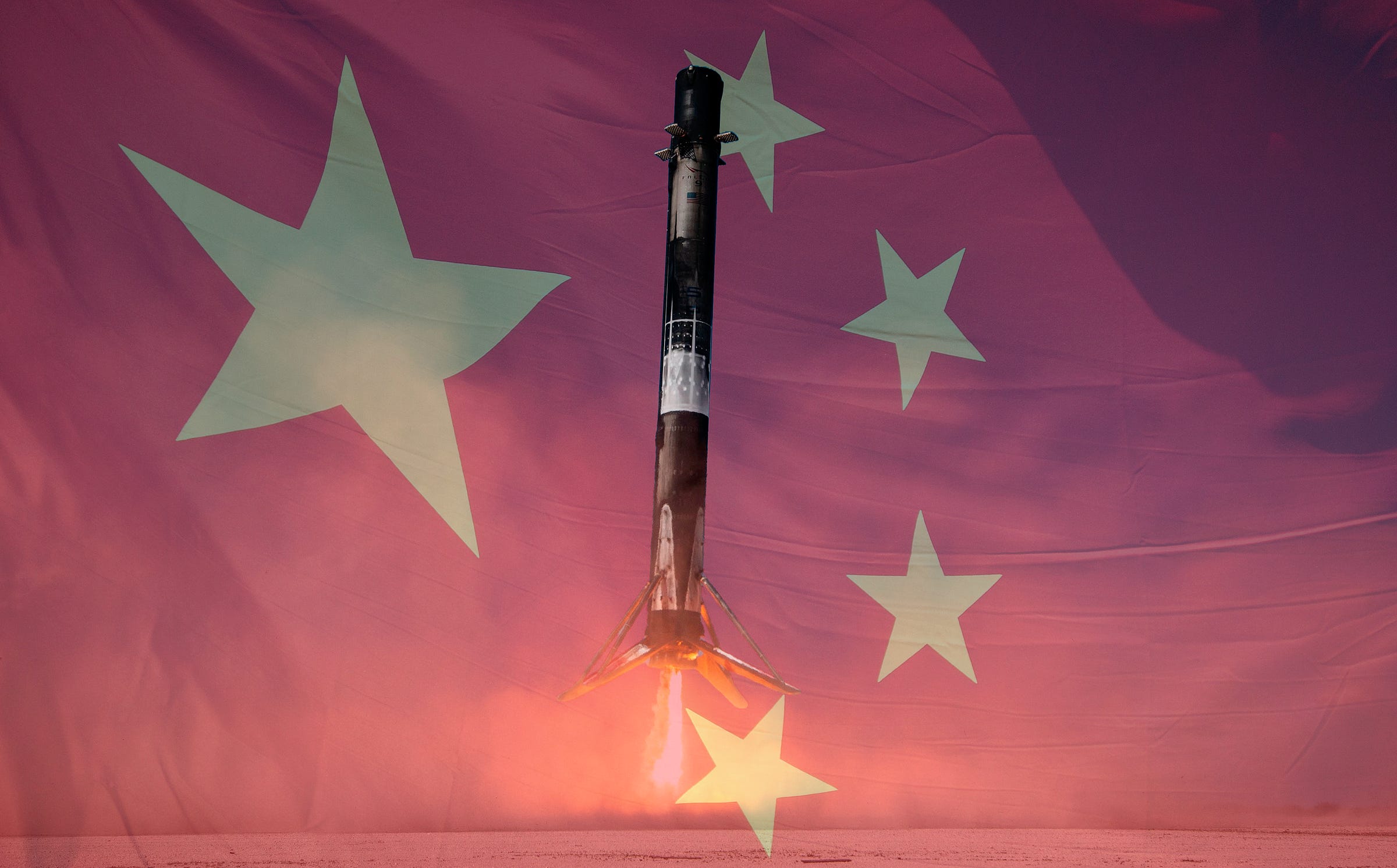

Why Do China’s Reusable Rockets Resemble Falcon 9?

And what they need to do to compete.

“Why does it look like Falcon 9?” is the most common question I receive and see when discussing China’s reusable rockets, and it’s a fine question, given the design decisions chosen by Chinese companies. So what are the reasons for the resemblance?

First, it’s necessary to understand SpaceX’s partially reusable Falcon 9 and its long and successful flight history. First flown in June 2010, the rocket has gone on to perform over 500 missions to orbit with only three outright failures and one partial failure. Alongside that, just over 470 first-stage boosters have landed autonomously either at sea or back at the launch site, greatly reducing the costs, thus expanding profit margins, of performing orbital launches for SpaceX.

Falcon 9 itself also has a fairly simple design, nine engines using the well-understood gas-generator cycle on the reusable first-stage, a vacuum-optimized engine of the same design on the expendable second-stage, and a well-known fuel combination of rocket-grade kerosene and liquid oxygen to provide the needed energy to reach orbit. What SpaceX had left to figure out was autonomous guidance for landing first-stage boosters, as well as suitable materials to protect the engine section of the vehicle and to ensure four grid fins did not melt during reentry or descent. Luckily, the company had a helping hand for landing guidance through the NASA-funded DC-X program. Thermally resistant materials capable of multiple flights were eventually tested and implemented in the earlier Falcon 9 flights1.

To summarize, Falcon 9 has proven to be highly reliable while not utilizing a complex design with few niche technical breakthroughs needed, making it an appealing choice for replicating, as the laws of physics are the same everywhere.

Meanwhile from a policy perspective, China's Scientific Outlook on Development (科学发展观), an idea continued from Hu Jintao’s (胡锦涛) Administration2 with roots in Jiang Zemin’s (江泽民) tenure3, emphasizes resource efficiency and evidence-based decision-making. The policy provides ideological justification for what could otherwise be considered technological imitation, instead portraying it as sensible resource management based on scientific principles that encourages sustainable development approaches while avoiding the inefficiencies of duplicating costly research efforts. In this regard, rather than reinventing reusable rocket technology from first principles, learning lessons from Falcon 9's proven architecture is a scientifically rational decision and allocation of resources.

Considering a wider strategic outlook, there’s President Xi Jinping’s (习近平) push for self-reliance in science and technology due to geopolitical competition with the United States. Falcon 9’s success commercially has led to it being a tool of American soft and hard power, providing affordable launches for foreign and domestic customers. That affordability has allowed the U.S. military to deploy an expansive spy satellite constellation. In parallel, cheap launches have given the United States diplomatic leverage, as other nations rely on American rockets to place their payloads in orbit. As such, fielding reusable rockets in the same or equivalent performance class as Falcon 9 could pry away current international customers who do not want to be overly reliant on SpaceX.

It is worth noting that privately-owned launch companies will not be dedicatedly in-line government ideology, but Party membership at various levels within them will see enterprises not stray too far.

Lastly, the most significant factor, and combination of previous factors, driving the Falcon 9 resemblance are market forces in China4. About a dozen privately owned Chinese space launch companies are speeding toward fielding reusable rockets, as they will lower overall costs and consequently allow for greater competitiveness. Unlike state-owned enterprises5, private space launch ventures cannot burn cash for several years and face investor pressures for timely returns through market validation. Therefore, drawing lessons from Falcon 9 saves both time and capital, allowing some companies to beat their competitors to the market.

COMAC surprise for launch?

In the airline industry, the Commercial Aircraft Corporation of China (中国商用飞机有限责任公司), commonly known as COMAC, surprised Western giants Airbus and Boeing with its aggressive manufacturing scale-up, delivering twelve C919 aircraft, competing with the 737 and A320, in 2024 from just two in 2023. The company raised its 2024 production target to seventy-five units and aims for two hundred annually by 2029, demonstrating a manufacturing ramp-up pace that compressed usual industry timelines through state support and infrastructure investment.

The surprise has been amplified by COMAC's growing momentum, initially driven by domestic Chinese carriers but increasingly expanding internationally. The C919 is in pursuit of European certification in 2025 too. With a combination of guaranteed domestic orders and emerging international interest has created sufficient customer demand to support their production scaling, positioning COMAC to grow its operations towards those of Boeing and Airbus. All of the above is supercharged by being more affordable and having a shorter backlog.

COMAC is a good equivalent example for China’s space sector that could be repeated, despite U.S. law trying to prevent it. Similarly, China’s reusable rocket efforts are being supported by investments at various government levels and companies’ own infrastructure build-ups in manufacturing facilities and launch pads.

With that in mind, to compete with Western launch solutions, China’s reusable rockets need to be affordable and flying regularly. Luckily for the Chinese launch market, a dozen private companies are hoping to fly reusable rockets initially a few times a year before scaling to a few times each month, or even weekly. Considering that SpaceX will likely be the main competition, having flown 138 times in 2024 (most with Starlink) and is on track to fly almost 200 times this year6, China would only need ten companies to fly a little more than once a month to keep close pace7.

Relative to costs in the West, reusable rockets in China may already have an advantage. If costs remain close to expectations for between three to seven Qianfan constellation launches, launch vehicles like Zhuque-3, Kinetica-2, and Tianlong-3 cost somewhere between 26.5 and 63 million United States Dollars8. That’s already about parity with SpaceX’s cost to customers at the high end, and those costs will come down, like the Long March fleet, as flight rates scale up along with manufacturing of expendable second-stages. Non-SpaceX western launch vehicles that are already flying are in a worse spot to compete. Europe’s Ariane 6 is being subsidised, to the tune of hundreds of millions of Euros each year, to compete with Falcon 9; meanwhile, United Launch Alliance’s Vulcan has an extensive backlog to fly while slowly increasing its flight count.

Matching SpaceX's costs are only part of the equation. Reliability will be the true test of the country’s new reusable rockets, as very few launch vehicles share commonality between major components, like engines, so each company needs to gradually prove its systems and capabilities9. The few exceptions to that are those utilizing the YF-102, made by the Academy of Aerospace Liquid Propulsion Technology, or Longyun, from Jiuzhou Yunjian (九州云箭), but with the potential problem of a failure for one rocket holding up several. An advantage of choosing those engines, however are cost savings to better innovate, and therefore compete, elsewhere.

Beyond proving their reliability, reusable Chinese rockets face market access challenges. China likely won’t be allowed to launch many, if any, Western satellites in the coming years due to existing restrictions. Initial launch demand will be driven by a mix of private and state-backed low Earth orbit mega-constellations. Although in the near future it’s not difficult to imagine a hypothetical Belt and Road Initiative-financed10 satellite constellation launching on affordable Chinese reusable rockets to utilize future demand from growing economies in Global South nations.

This would be around 2018, before sixty flights of the rocket took place.

From November 2002 to March 2013.

Jiang Zemin was President of China from March 1993 to March 2003.

Why China, a socialist state, has markets and private enterprises is explained in section two of a piece titled “Why China Has a Private Space Sector”.

The China Academy of Launch Vehicle Technology and the Shanghai Academy of Spaceflight Technology are two state-owned enterprises pursuing reusable rockets on a slower, more methodical timeframe, as they don’t need to conform to market forces anywhere near as heavily.

During writing, on August 18th, Falcon 9 flew its 100th mission of 2025.

This would obviously be a few years from now, and assuming the in-development Starship-Super Heavy rocket slowly takes Falcon 9’s Starlink launch duties.

Additional launch contracts awarded to China’s reusable rockets will improve understanding, increasing the accuracy of estimates, of costs to customers.

This challenge has been demonstrated by failures of the expendable Kinetica-1 from CAS Space and Zhuque-2E from LandSpace in the past twelve months.

The Belt and Road Initiative is a global infrastructure development strategy launched by China in 2013 aimed at enhancing trade and economic connectivity in Asia, Europe, Africa, and the Americas through infrastructure investments.

The company which masters the art of developing the supreme , optimzed , efficient and simple product will be followed by the rest of the companies . For example, why all the smarphones look like IPHONES because the design that Apple introduced was so simple , so optimized and so efficient that no other company could beat that , so the rest of the smartphone makers have no choice but to build on the foundational design of IPHONE. . Similarly, the design and I also believe the very engine of SpaceX's Falcon 9 rocket is so unique , so simple , so efficient and so optimized that all the other companies have no choice but to follow that .

Regards